August 8, 2023 | 8 min read

What's wrong with your LOS - Part I

Mario DiBenedetto

Managing Director

Based on our experience developing mortgage-related software for top 50 lenders for over 20 years, we know that all lenders suffer the same 8 challenges around their loan origination system, regardless of which system they are using. Our assertions are two-fold:

- First, it is highly unlikely that you will eliminate ANY of these 8 issues by changing your LOS. To be clear, we are not saying you can’t eliminate ALL 8, we are stating you will not eliminate ANY.

- Second, given the first assertion, your resources and energy are better served at “fixing” what you have.

This article is being separated as 3 different parts, Part I and Part II will review each of the 8 challenges in-depth and Part III will emphasize on why you should retain your LOS despite the problems being faced by the lenders. See if you can relate to how each of the issues manifests itself in your company and whether you have any confidence they will be eliminated.

1. Allow for Poor Quality Loans

Mortgage loan origination systems (LOS) are designed to streamline the mortgage lending process and ensure that loans are originated efficiently. However, these systems consistently fail to prevent poor quality loans from being originated. We have yet to meet a lender with zero loan defects and zero post-closing remediation. Similarly, we have yet to see a LOS that can guarantee zero defects. This is due to a variety of reasons:

Inadequate Underwriting Criteria

LOS systems usually rely on predefined underwriting criteria to evaluate borrower qualifications and determine loan eligibility. Alternatively, some LOSs require you to define all of the underwriting criteria. If the criteria are too lenient or not comprehensive enough, it can result in loans being approved for borrowers who may not have the ability to repay them.

Relatedly, sometimes the underwriting criteria is very clear but the LOS fails to enforce it properly. Despite being automated systems, mortgage LOS often involve human interaction and decision-making. Loan officers and underwriters have the ability to override or bypass certain system recommendations or guidelines based on their discretion. This introduces the potential for human error, biases, or even intentional manipulation, which can result in the approval of poor quality loans. How often have you seen a loan properly evaluated only to have a last minute change require it to be re-evaluated on a rush basis and something gets missed in the rush? Your LOS should not allow that to occur!

Inaccurate or Insufficient Data

LOS systems heavily rely on the accuracy and completeness of the data provided by borrowers and third-party sources. If the data entered into the system is inaccurate or incomplete, the system may not be able to make accurate loan decisions.

Sometimes the data exists but the LOS does a poor job of transferring it to/from other systems. We’ve seen numerous situations where the data exchanged between a LOS and a document prep vendor was poorly mapped, resulting in poor quality loan documents. Your typical loan has somewhere between 12-20 3rd-party vendor interactions. Every one of these is a likely source of incomplete or inaccurate information.

Systemic Issues and Technical Glitches

Mortgage LOS systems are complex software platforms that require continuous maintenance and updates. Systemic issues or technical glitches can sometimes occur, leading to errors in the loan origination process. These issues can result in incorrect calculations, misinterpretation of data, or even system failures, all of which can contribute to poor quality loans being approved.

A sad truth is that several of the LOS vendors are not staffed to do root cause analysis when issues like this occur. So, you’re not only left with the resulting flawed loans, but you are also left with a high likelihood the underlying problem will recur.

2. Chaotic Communications

Mortgage loan origination systems (LOS) play a critical role in facilitating communication among various stakeholders involved in the loan origination process. However, there are instances where these systems can foster chaotic communications, leading to confusion and inefficiencies. Here are some factors that contribute to this problem:

Communication is an Afterthought

LOS systems often lack centralized communication channels that enable seamless and organized communication among loan officers, underwriters, processors, borrowers, and other parties involved in the process. The design of most LOSs is oriented towards loan production rather than collaboration. So, typically, the idea of communication is “tacked on” by adding email or a notification panel. This totally disregards the collaborative aspects of how origination teams actually want to work.

Effective communication in the loan origination process requires collaborative tools that facilitate discussions, document sharing, and task assignment. Similarly, LOS systems should have robust notification and alert systems that inform stakeholders of important updates, requests for information, or pending tasks.

If an LOS system lacks such tools or provides inadequate functionality, stakeholders may resort to using alternative means of communication, such as emails or file-sharing platforms. This fragmented approach can lead to miscommunication, version control issues, phone calls, printing of documents, manual checklists, and difficulty tracking the progress of tasks. Or, maybe our favorite, it can lead to rampant check-the-checker behavior where everyone feels compelled to re-check everyone else’s work.

Incomplete or Delayed Information

LOS systems rely on accurate and timely information for effective communication. However, if the system does not provide real-time updates or if there are delays in data entry or verification, it can lead to incomplete or outdated information being communicated. This can create confusion and misunderstandings among stakeholders, leading to chaotic communication.

This issue can be particularly tricky because there are times when something changes on a loan file and the inclination is to immediately communicate the change BUT, unbeknownst to the communication system, a subsequent change occurs a few minutes later that significantly alters the meaning of the first change. When email is your primary communication tool, it’s incumbent on the recipient to open the loan and determine if such an instance occurs.

Lack of Transparency and Visibility

Chaotic communication can also arise when stakeholders do not have visibility into the status and progress of the loan application. LOS systems should provide clear visibility into the loan origination pipeline, including the stage of each application, pending tasks, and any bottlenecks. And, going beyond the LOS, all of the peripheral systems used need to reflect the LOS’s loan status. If your LOS lacks the ability to communicate data and documents out to all of your other systems, it is a source of confusion more than a source of truth.

3. Inflexibility

Mortgage LOSs can sometimes be inflexible, meaning they have limited customization options or lack the ability to adapt to specific lender requirements or market changes. Here are some ways in which LOS systems can be inflexible and the impact it can have on the loan origination process:

Inability to Customize Workflows

Each mortgage lender has unique workflows and processes that they follow based on their business model, risk appetite, and compliance requirements. However, most LOS systems do not offer sufficient flexibility to customize workflows to align with these specific needs. Specifically, workflow needs to be configurable in such a way that there are no limitations on how a loan moves through the process. Included is the ability to have more than one task on a loan be worked-on in parallel.

This lack of customization and configurability can force lenders to modify their processes to fit within the constraints of the system, potentially leading to inefficiencies, increased manual workarounds, and a disruption of established operations.

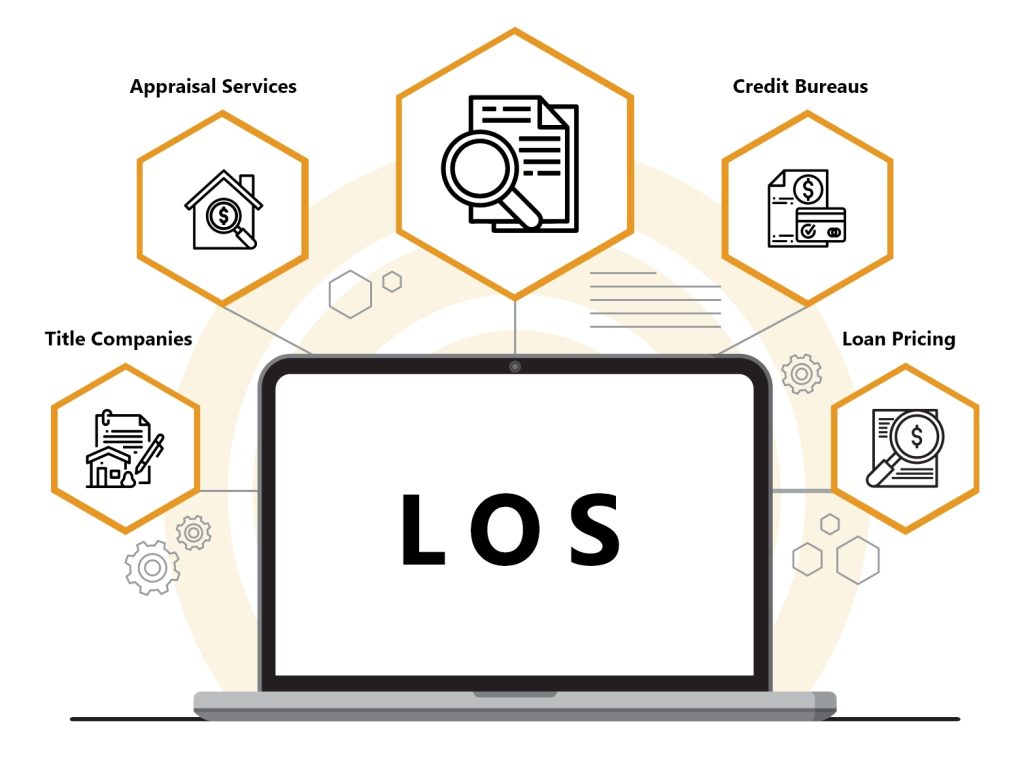

Inadequate Integration Capabilities

Effective loan origination requires seamless integration with various third-party systems, such as credit bureaus, appraisal services, title companies, and loan pricing engines. The most basic issue here is that the LOS does not have integrations to enough vendors in each category. Without this, you as a lender are limited in your ability to negotiate with your vendors on price because you have no alternatives.

The next level issue is the association of vendors to workflow. Without this association, you cannot automatically trigger new orders or automatically assess order results when they are returned.

Lastly, unless you have created your own custom tools, it is guaranteed that you lack the ability to have automated ordering that can “search” for the best price across vendors before placing orders, thus giving you maximum leverage with your vendor partners.

Difficulty in Adapting to Regulatory Change:

The mortgage industry is subject to frequent regulatory changes, aimed at ensuring consumer protection, fair lending practices, and risk management. LOS systems must be able to swiftly incorporate these regulatory updates into their functionality to support lenders' compliance efforts. However, if an LOS system is inflexible and cannot easily adapt to regulatory changes, it often exposes you to compliance risks, necessitates manual workarounds, or requires expensive and time-consuming system updates.

Limited Product Offerings:

Mortgage lenders typically offer various loan products tailored to different borrower segments or market demands. However, some LOS systems have limited product offerings, making it difficult for lenders to expand their loan portfolio or introduce new products. It probably comes as no surprise that every major LOS on the market started by handling 30 year fixed GSE products end-to-end. Every loan product flavor after that was shoe-horned into the 30-year fixed flow.

To be fair, even the most experienced mortgage technologist can’t anticipate every aspect of as yet undefined loan products. The best you can do to assess any LOS is to get specific examples of the last 3 new loan products enabled by the platform and what the start-to-finish time required was for them.

Lack of User Interface Customization:

The user interface of an LOS system plays a crucial role in the user experience and productivity of loan officers, underwriters, and other stakeholders. However, some LOS systems may not provide adequate customization options for the user interface, limiting users' ability to tailor the system to their specific preferences or work style. And most LOSs adopt a “data exists in just one screen” approach that makes it easy to program and maintain but has no alignment to how your team actually needs to work with the data. This inflexibility can impact efficiency, user satisfaction, and the overall user adoption of the LOS system.

4. Lack of visibility and insights

A lack of process visibility and insights in a mortgage loan origination system can have significant impacts on the loan origination process. In this context, “process visibility” means an awareness of precisely what has already been done on a loan, what has not been done on a loan, what role(s)/skills are required to complete the remaining tasks and what is the timing of the estimated completion for each outstanding task.

Here are some key impacts when some or all of these elements are unclear:

Inefficiency and Delays:

Without clear process visibility, lenders and stakeholders may struggle to track the progress of loan applications, identify bottlenecks, or determine the status of pending tasks. Your team is left to either guess how to “discover” the work that needs to be done or to devise their own tracking systems (Spreadsheets rule!).

Poor Decision-Making:

Process visibility is crucial for making informed decisions throughout the loan origination process. Without insights into the status of applications, relevant documentation, or potential risks, loan officers and underwriters may make suboptimal decisions or overlook critical information. More than likely, it is a current source for loan rework such as when something gets done prematurely or out of sequence.

Compliance Risks:

Process visibility is crucial for making informed decisions throughout the loan origination process. Without insights into the status of applications, relevant documentation, or potential risks, loan officers and underwriters may make suboptimal decisions or overlook critical information. More than likely, it is a current source for loan rework such as when something gets done prematurely or out of sequence.

Inability to Identify Process Inefficiencies:

Process visibility provides lenders with insights into the loan origination workflow, allowing them to identify inefficiencies and areas for improvement. Without this visibility, lenders may struggle to identify bottlenecks, redundant steps, or areas where automation or streamlining can enhance the loan origination process. As a result, the organization may miss opportunities to optimize its operations, reduce costs, and enhance the overall customer experience.

Similarly, without visibility into process performance metrics, there is no way to know if process or technology changes are improving or reducing throughput.

Customer Dissatisfaction:

A lack of process visibility can negatively impact the borrower experience. Borrowers expect transparency and timely updates throughout the loan origination process. When lenders cannot provide clear visibility into the status of applications or communicate proactively, it can lead to customer frustration, increased inquiries, and a poor overall borrower experience.

Continue reading on Heavy vendor dependencies, Undifferentiated, Outdated technology and more on our What’s wrong with your LOS – Part II.