The Brimma Promise: You will never be charged for any product or service until you are 100% satisfied that it meets your expectations. We let you do unlimited upfront testing before you Go Live!

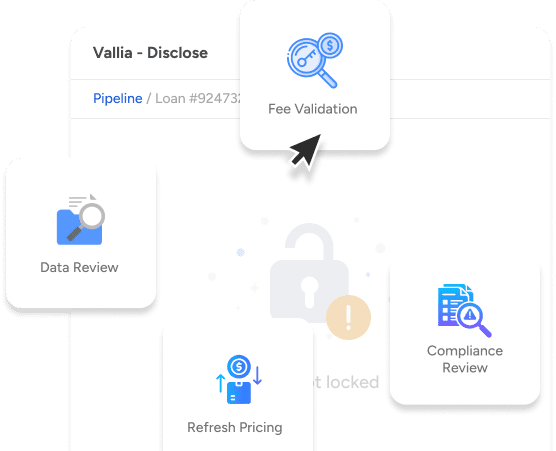

Vallia Disclose

Your one-stop solution to an efficient disclosure process.

Automate Your Disclosure Process to Eliminate Errors and Deliver Accurate, Compliant Loan Estimates On Time—Every Time

Vallia Disclose takes the stress out of generating Loan Estimates by automating data validation, repricing, and compliance checks—all before any document is sent to your borrower. In today’s fast-paced lending environment, errors and delays in disclosures can lead to costly setbacks and regulatory risks. Vallia Disclose ensures that every piece of loan data is correct and compliant, allowing you to focus on delivering a seamless borrower experience.

The automation in Vallia Disclose integrates directly with your pricing engine and compliance systems. It automatically recalculates loan terms and fees based on real-time market data and validates every detail to ensure accuracy. If any data triggers a compliance flag, the system halts the disclosure process until the issue is resolved—protecting you from non-compliance penalties.

By consolidating validation, pricing, and compliance tasks into a single automated process, Vallia Disclose reduces manual effort, eliminates human error, and speeds up your loan origination workflow. You get the confidence of knowing that every disclosure is timely, accurate, and fully compliant.

Comprehensive

Contains custom validations that ensure every disclosure is fully validated

Integrated

Combines your LOS, pricing engine, fee engine, and compliance engine

Borrower Experience

Fewer unneeded disclosures means happier customers

Key Features

01.

Automates data validation, ensuring all loan information is accurate before disclosures are generated.

02.

Integrates with pricing engines to automatically update loan terms based on real-time market data.

03.

Compliance checks are built-in, flagging any issues before documents are sent to borrowers.

04.

The system consolidates validation, pricing, and compliance into a single streamlined process.

05.

This automation saves time, reduces errors, and ensures accurate, compliant disclosures every time.

Vallia Disclose users deliver higher quality disclosures in far less time, improving operational efficiency and eliminating avoidable tolerance cures

Schedule a demo today to see the power of Vallia Disclose in action and take your business to the next level.