Accelerate innovation and production with Brimma's

AI-powered Vallia

Vallia leverages AI to help lenders speed up pipelines, reduce origination costs, and maximize ROI.

Vallia - Overview

Brimma's VALLIA, powered by AI, offers a comprehensive solution for all of your loan management needs, enabling LOS stakeholders to initiate, execute, and finalize the loan process efficiently with a suite of productivity tools.

VALLIA is a collection of integrated components and applications designed to work seamlessly, providing you with a modern, task-driven overlay to your Loan Origination System.

With AI at its core, VALLIA revolutionizes the loan management process, providing unparalleled validation, automation, prioritization, and optimization to elevate your Loan Origination System experience.

Brands That Trusts US

Vallia AI DocFlow

Vallia DocFlow is a state-of-the-art document management solution that seamlessly integrates with your existing document classification and data extraction tools. It tackles the “last mile” problem in document processing, enhancing the efficiency and accuracy of your automation. Vallia DocFlow lets valid documents bypass tedious manual reviews, so your team can focus on

Vallia AI LeadNexus

Vallia AI LeadNexus (VLN) revolutionizes lead management for mortgage loan officers with its cutting-edge AI capabilities. Designed as an AI-first speed-to-lead tool, VLN enhances lead conversion rates effortlessly. By automating initial tasks, providing intelligent recommendations, and streamlining communication, VLN integrates seamlessly with existing lead sources. Its user-friendly interface empowers loan officers to optimize productivity and achieve better results.

Vallia AI Voice-to-LoanApp

Vallia AI Voice-to-LoanApp is a cutting-edge solution designed to streamline the loan application process. By leveraging advanced AI technology, Vallia transforms borrower conversations into industry-standard data payloads, ready to be imported into any Loan Origination System (LOS). This innovative tool empowers loan officers to focus more on meaningful interactions with borrowers rather than getting bogged down by administrative tasks

Vallia Chat

Your streamlined solution for accessing loan data. Say goodbye to endless clicks and screen-hopping. With Vallia Chat, accessing crucial information is fast, intuitive, and tailored to your needs. From loan officers to processors, our easy-to-use interface frees up valuable time, ensuring seamless workflow efficiency. Welcome to the bridge to your data.

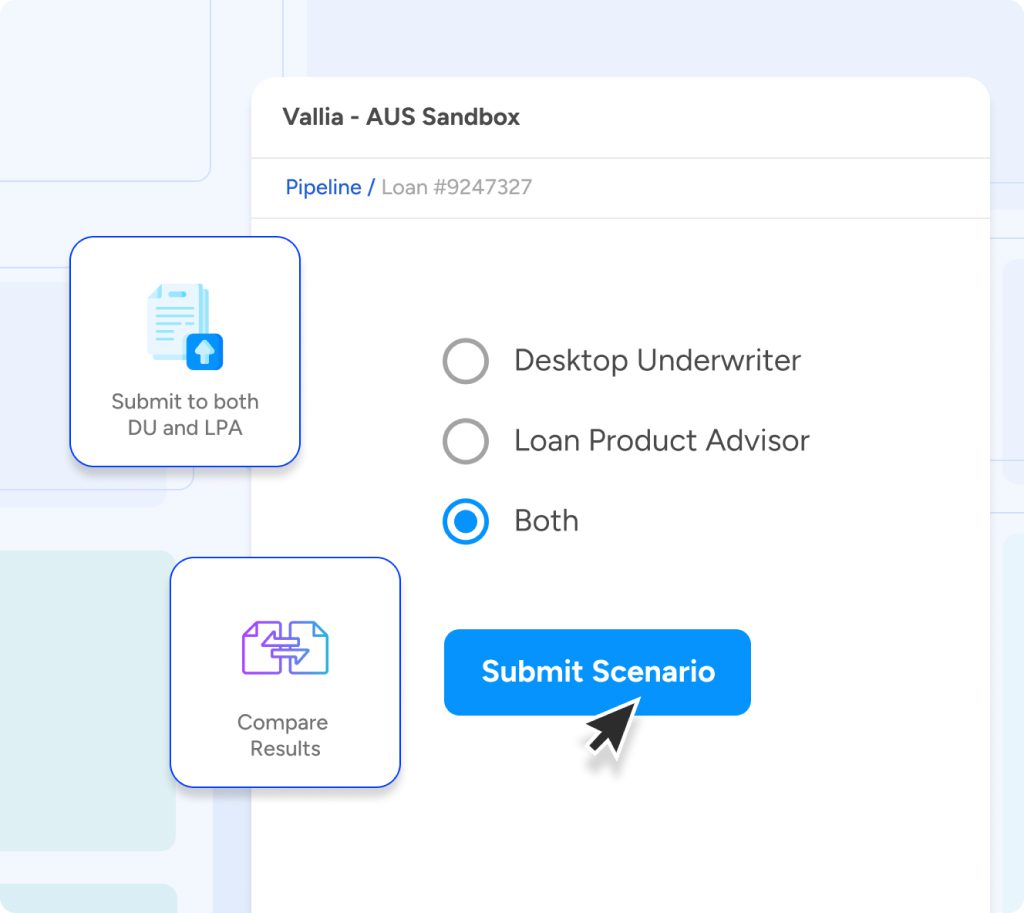

Vallia AUS Sandbox

Empower your lending process with unparalleled flexibility and control. Effortlessly optimize loans while maintaining compliance. Our user-friendly platform enhances efficiency and profitability, streamlining submissions to both DU and LPA with just one click. Experience seamless side-by-side comparisons and detailed insights to maximize your lending potential.

Vallia Disclose

Your solution to streamline initial disclosures. Say goodbye to errors and inefficiencies with our comprehensive tool. Designed for any role, it improves loan quality, ensuring compliance and accuracy from the start. With Vallia Disclose, tackle data validations, pricing, and compliance effortlessly. It's time to simplify your disclosure process.

Vallia Lead Expeditor

Vallia Lead Expeditor (VLE) is a simple speed-to-lead tool that loan officers can link to their existing lead sources. It helps drives lead conversion through a combination of automated outbound phone calls, text messages, and email messages to the loan officer and to the prospect.

Vallia - Benefits

AI-Powered Validation

Without centralized validations, issues can easily slip through the cracks.

VALLIA’s AI-driven validation processes ensure that data is thoroughly checked before automation is triggered, significantly reducing loan processing time.

AI-Driven Automation

Recurring tasks often require excessive human effort.

VALLIA harnesses the power of AI to automate your manual tasks, allowing you to focus on the tasks that need your expertise the most.

AI-Based Prioritization

Users often lack guidance on what the most pressing tasks are across all their assignments.

VALLIA uses AI to prioritize your workload, ensuring that you address the most critical tasks first.

AI-Enhanced Optimization

Disorganized systems can require more screens and time than necessary.

VALLIA optimizes your workflow by utilizing AI to make every task more efficient, ensuring your time is used effectively.

Zero

missed lock extensions

25%+

efficiency gain for loan setup and processing

Zero

violations in initial

disclosure content and timing

30%+

efficiency gain for disclosure desk

10%+

improved customer experience ratings throughout the loan life cycle

50%+

reduction in surprises within 3 days of closing

Zero

missed lock extensions

25%+

efficiency gain for loan setup and processing

Zero

violations in initial

disclosure content and timing

30%+

efficiency gain for disclosure desk

10%+

improved customer experience ratings throughout the loan life cycle

50%+

reduction in surprises within 3 days of closing

Testimonials

See What Our Clients Are Saying About Us.

“Brimma's UX/UI team was able to quickly bring our vision alive. Their mortgage industry experience made the process a lot easier.”

Jim Cutillo

Founder and CEO

AppraisalVision

“Brimma's team demonstrated unparalleled expertise and dedication throughout the implementation of cutting-edge technologies, significantly enhancing our productivity. Their proactive approach to understanding our unique business requirements allowed for the seamless integration of solutions tailored to our specific needs.”

John Norris

Chief Technology Officer

Benchmark Mortgage

“Brimma has been our 'go to' partner with unique mortgage domain and technical know-how to quickly deliver the modern automation that keeps us ahead of the competition.”

Sue Melnick

Chief Operating Officer

BayEquity Home Loans

“We first commissioned Brimma to help build out our User Experience, but their responsiveness, team approach, ingenuity and ROI has us coming back for more complex development work”

Jim Magner or Joe

Chief Operating Officer

ReverseVision

“I have worked with many app development firms and all of them had strengths, but the Brimma team brought a full stack of talent to the table that I hadn’t seen in many larger firms. I won’t be looking anywhere else for help.”

Devin Dally

Chief Revenue Officer

TRUE

“We had a definite need to expand our senior software development team to design modern, cutting edge front-end consumer solutions, and Brimma Tech was a perfect fit. I value a company I can seamlessly work with and even learn from. And, Brimma is that company.”

Steve Octaviano

Chief Technology Officer

Blue Sage Solutions