Vallia Data Connect

Seamlessly integrate and optimize your CRM and LOS workflows with Vallia Data Connect.

Overview

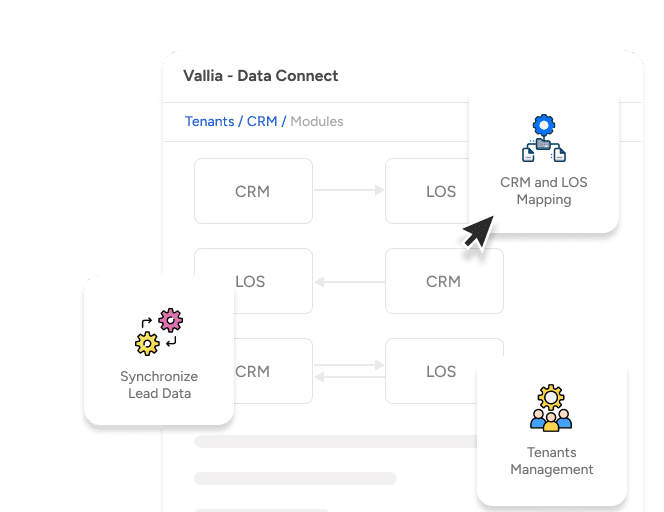

In the mortgage industry, data serves as the lifeblood, driving informed decisions and strategic adaptations. Vallia Data Connect bridges the gap between Loan Origination Systems (LOS) and Customer Relationship Management (CRM) platforms, providing mortgage companies with a powerful data management solution. Vallia Data Connect isn't merely about integrating technologies—it's about empowering mortgage companies with the tools they need to deliver exceptional client experiences, drive efficiency, and achieve sustainable growth in a competitive market landscape.

Typical Client Challenges and Concerns

Communication Breakdowns:

Traditionally, Marketing teams oversee Customer Relationship Management (CRM) systems, while product teams manage Loan Origination Systems (LOS). This division creates data silos, hindering effective collaboration between the two teams.

The CRM is pivotal for nurturing leads, devising communication strategies, and tracking the entire customer journey. However, without integration with the LOS, crucial customer data remains fragmented. Combining CRM data with the LOS streamlines the mortgage loan process, enabling seamless personalization and uncovering future upsell or cross-sell opportunities.

Identity and Preference Ambiguity:

Without comprehensive data integration, understanding customer identities and preferences remains challenging. While the LOS captures financial data, it lacks insights into customer profiles and preferences. By merging financial data from the LOS with customer profiles from the CRM, organizations gain the necessary tools to leverage data effectively and deliver personalized experiences throughout the customer journey.

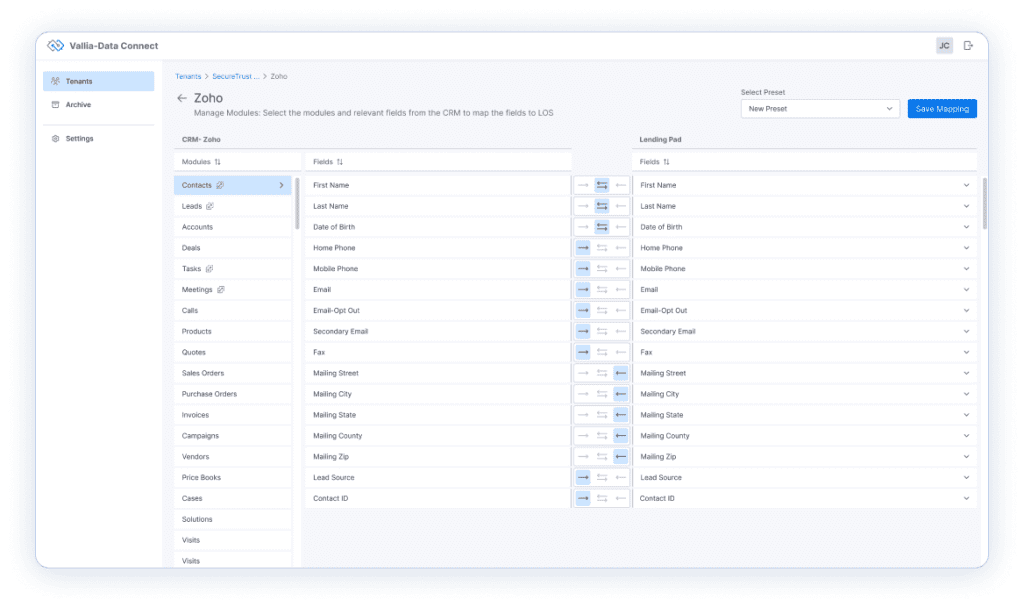

Brimma’s Remedy

Vallia Data Connect (VDC) represents a robust iPaaS (Integration Platform as a Service) leveraging APIs to seamlessly connect any CRM to any LOS. Regardless of whether you utilize legacy systems or maintain a hybrid cloud and on-premises environment, VDC serves as a vital bridge for data integration. Transferring data between the LOS and CRM can be tailored to align with your business needs, whether scheduled daily, weekly, hourly, or in real-time. Additionally, custom fields within your CRM or LOS can be seamlessly integrated. Personalized integration is facilitated through the creation of a comprehensive data map by our expert developers.

Data Utilization for Business Growth:

Integrated LOS and CRM systems centralize client information and transaction history, empowering mortgage companies to analyze data effectively. By leveraging insights, businesses can identify trends, adapt strategies, and fuel growth in dynamic market environments.

Exceptional Client Experiences:

Seamlessly integrating LOS and CRM systems enhances client communication and service. Real-time access to client data ensures loan officers are well-prepared to assist clients promptly, resulting in happier clients, heightened satisfaction, and increased referrals and repeat business. Case studies demonstrate a notable 20% rise in client satisfaction with integrated systems.

Efficiency Enhancement:

Vallia Data Connect optimizes workflow by streamlining the mortgage application process, from client inquiries to loan approval. This integration minimizes redundancy and automates processes, significantly boosting efficiency. Loan officers can access comprehensive client information and loan details in one place, reducing errors and saving time, resulting in heightened productivity and streamlined operations.

Vallia Data Connect