The Brimma Promise: You will never be charged for any product or service until you are 100% satisfied that it meets your expectations. We let you do unlimited upfront testing before you Go Live!

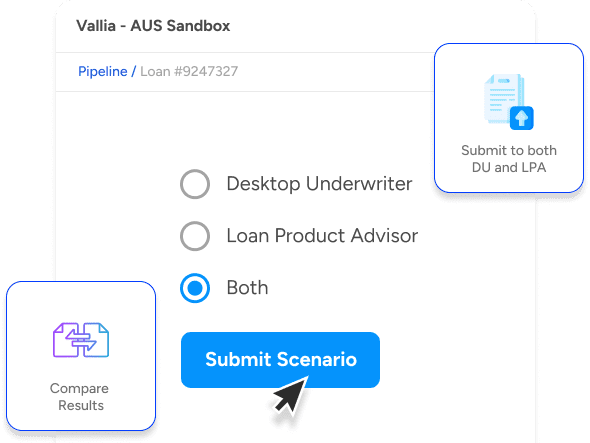

Vallia AUS Sandbox

Automated Underwriting System submissions simplified.

Eliminate unneeded Change of Circumstances and Stop Confusing Your Borrowers With Disclosures That Are Irrelevant

Chances are, your LOS forces you to “save” your loan data changes before you can resubmit the loan to GSE AUSs. In our experience, this is not only one of the largest sources of CICs but also, by far, the most easily avoided.

That’s the idea behind Vallia AUS Sandbox. You get the power to create alternate loan scenarios and resubmit them to GSE AUSs without committing to any specific scenario. Only when you’ve run all of your scenarios do you “update” your LOS with the scenario that best fits your borrower’s situation.

This gives you flexibility without sacrificing compliance. That’s because every AUS call is still logged in your AUS and any findings returned are also put into your LOS.

Easy to Use

Because of how it fits into your business process, adoption is easy for your loan officers and underwriters

Increased Efficiency

Loan scenarios enable loan officers the freedom to test unlimited options

Increased Profitability

One-click dual AUS for every scenario ensures the highest profitability

Key Features

01.

The ability to create and save unlimited loan scenarios for your borrowers.

02.

Submit loans to dual AUS systems in just one effortless, single click.

03.

Automated AUS findings comparison and recommendation.

04.

Seamlessly Integrated directly with your LOS

05.

Configurable to your workflow

Users of Vallia AUS Sandbox see a marked decrease in unnecessary COCs and unneeded disclosures sent to their borrowers

Schedule a demo today to see the power of Aus Sandbox in action and take your business to the next level.