February 22, 2023 | 3 min read

Creating More User-Centric Mortgage Applications: The Importance of a Good UX

Gopakumar TV

Director – UX & Creatives

The mortgage industry is a vital component of the US economy, with millions of Americans relying on home loans to achieve the dream of homeownership. As the mortgage industry continues to grow, the importance of providing a good user experience (UX) for customers has become increasingly important. In this blog, we will discuss how a good UX can help the US mortgage industry create more user-centric software applications.

First, let's define what we mean by user experience. UX is the overall experience a user has when interacting with a product or service. It encompasses all aspects of the user's interaction, including the design, usability, accessibility, and functionality of the product. A good UX is essential for any software application to succeed, as it can make or break the user's experience and determine whether they continue to use the product.

One of the main benefits of creating more user-centric software applications is increased customer satisfaction. When a user interacts with a software application that is intuitive, easy to use, and aesthetically pleasing, they are more likely to be satisfied with their overall experience. This satisfaction can lead to increased loyalty and repeat business, which is essential in the competitive mortgage industry.

Another benefit of a good UX is increased efficiency. When a software application is designed with the user in mind, it can streamline the mortgage process, making it faster and more efficient. This can lead to cost savings for both the lender and the borrower, as the process can be completed more quickly and with fewer errors.

A good UX can also increase transparency and trust in the mortgage process. By providing clear and concise information, users can better understand the loan process and make informed decisions. This transparency can lead to increased trust in the lender, which is essential in an industry where trust is paramount.

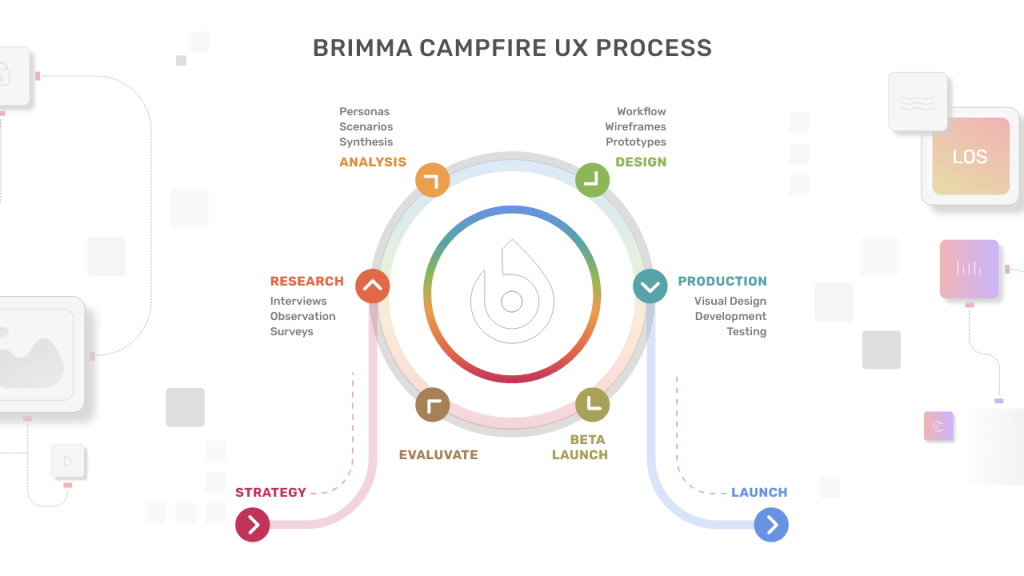

To create more user-centric software applications, the mortgage industry must focus on UX throughout the entire development process. This includes conducting user research to understand the needs and pain points of users, designing intuitive and aesthetically pleasing interfaces, and testing the application with real users to ensure usability and functionality.

In conclusion, a good user experience is essential for creating more user-centric software applications in the US mortgage industry. By focusing on UX throughout the development process, the mortgage industry can increase customer satisfaction, efficiency, transparency, and trust. As the mortgage industry continues to grow, providing a good user experience will become increasingly important in staying competitive and meeting the needs of customers.

If you’re looking for a partner to help you revolutionize your enterprise UX, Brimma Tech, Inc. is here to help. Contact us today to learn more about our UX capabilities and how we can help your business thrive in the digital age.